Volatile Markets? Try Non-Correlated Investments

At a recent meeting of the Ritossa Family Office Summit in Dubai, Jagdeesh Prakasam said something that caught the attention of the several hundred investors who were listening to him.

He said that by using artificial intelligence and machine-based learning, his company has been able to capture some uniquely important inefficiencies in the financial markets. The result?

Achieving Positive Returns in Volatile Markets

The company where Prakasam is Co-Chief Investment Officer, Rotella Capital Management, has been able to achieve positive returns in both up markets and down ones as well.

“In the last 26 years,” Prakasam told his audience, “we’ve had a track record of double digit uncorrelated returns through some of the most challenging market environments. This includes consistent absolute returns during times of crisis for traditional asset classes.”

He went to point to a revealing graph of some of the world financial crises in the last 20 years. Whether it was the Russian Financial Crisis in 1998, or the Dot.Com Bubble of 2002, or the Financial Crisis of 2009, or Brexit in 2016, when the US Stock market tumbled, Rotella’s investments went up.

So how does he go about finding the non-correlated investments that makes this kind of performance possible?

Rotella’s COO Ian Ram added, “We use a high tech, artificial-intelligence, machine-learning approach to complement our more traditional technical and statistical models. We have 13 research scientists, 10 senior technologists, and 20 other skilled personnel. These individuals include men and women with advanced degrees in physics, engineering, mathematic and financial engineering.”

But that’s only part of his secret sauce. “What we do is an intersection of art and science. The art part is, we begin with intuitive but highly-informed hypotheses and then we test the hypotheses. As part of the testing, we apply sophisticated scientific and mathematical approaches.”

Where Is It All Leading?

When quantitative easing ended in 2014, Prakasam’s colleague, Robert Rotella, knew that among the many implications of ending the six-year $4.5 trillion program, is that the U.S. Government would no longer be supporting the American stock market. This was likely to lead to volatility.

Ending similar liquidity-enhancing programs, whether in Europe or Japan, would also have large implications. After all, when quantitative easing isn’t in effect, it’s typical to have corrections of 10% or 15% in the stock market. Under normal circumstances, these may happen a couple of times a year.

However, during the period from 2008 to 2014, this kind of volatility wasn’t allowed to happen. This meant that for at least six years, investors didn’t have to worry that one of these market drops would happen. They didn’t have to worry about needing liquidity at a time when the market is down.

Today conditions have changed. Rotella’s premise is that investors who need less volatility need more non-correlated investments. He and his colleagues at Rotella put their enormous intellectual and technical resources into discovering investments that do well independently of the stock market’s roller coaster ride.

If you’d like to know more about Rotella Capital Management’s alternative asset approach, contact: [email protected]

Mitzi Perdue is a professional public speaker who talks on family business. Contact her at: [email protected].

Search Articles

Latest Articles

$15M New Hampshire estate owned by Perdue Chicken heiress once welcomed President Taft

https://www.boston.com/real-estate/luxury-homes/2025/09/29/new-hampshire-estate-knollwood-perdue-chicken-heiress-for-sale Publication – boston.com

Protecting the Grid: A $4 Billion Fix for a Multi-Trillion-Dollar Risk

https://foreignpress.org/journalism-resources/protecting-the-grid-a-4-billion-fix-for-a-multi-trillion-dollar-risk Publication – foreignpress.org

A New Hampshire Estate That Served as a Retreat for Mark Twain Lists for $15 Million

https://robbreport.com/shelter/homes-for-sale/knollwood-estate-new-hampshire-1237028979 Publication – robbreport.com

How AI Helped an Autistic Teen Find His Voice

https://foreignpress.org/journalism-resources/how-ai-helped-an-autistic-teen-find-his-voice Publication – foreignpress.org

Subscribe to Updates

About Author

Mitzi Perdue is the widow of the poultry magnate, Frank Perdue. She’s the author of How To Make Your Family Business Last and 52 Tips to Combat Human Trafficking. Contact her at www.MitziPerdue.com

All Articles

Family Businesses Can Learn from Military History

Family Businesses Can Learn from Military HistoryMilitary Culture My late husband was fascinated by military culture, and you could often find him reading the biographies of famous generals. His fascination stemmed from his interest in human motivation. He often...

Family Quarrels & Mediation–Pull Back from the Brink

Family Quarrels & Mediation– Pull Back from the BrinkI hope you’re not reading this because you’re up against a family quarrel. The pain of a family quarrel can permeate every hour of every day. The fallout has the potential of threatening everything we all hold...

What Family Businesses Can Learn From Military Culture

What Family Businesses Can Learn From Military CultureFor longevity and having an extraordinarily strong culture, few organizations can match our military. The military culture of our armed services began before the founding of our country, and it survives to this...

Four Sure-Fire Ways to Stand out in Your Career

Four Sure-Fire Ways to Stand Out in Your CareerA young man in a class I was addressing at a Columbia University business class asked me a poignant question. “How do I stand out in my career?” He was in his mid-twenties, professionally dressed, and his body language...

Family Stories Keep Families Together

Family Stories Keep Families TogetherJackie Kennedy Onassis once said: “If your children turn out well, nothing else matters. If your children turn out badly, nothing else matters.” Having the young people in your life turn out well is as important as anything else...

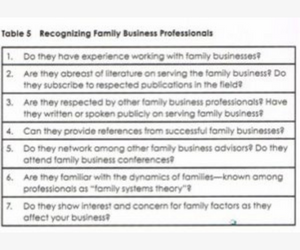

Choosing Your Family Business Advisors

Choosing Your Family Business AdvisorsKnow when you need to get help. People often ask me the secret of Frank Perdue’s success. He had to do hundreds of things right. He had to be able to see the big picture as well as be detail oriented. But there was something else:...