Silver Arrow’s Secret Sauce: An Investment Thesis Approach

Let’s suppose a delightful situation. One way or another (maybe through inheritance, or you got a bonus, or you sold your company) you have some money available to invest.

It’s a responsibility. What’s your best strategy for investing it wisely?

Gary Brode from Silver Arrow Investment Management has some suggestions for you. The suggestions happen to be a nice combination of innovative and practical. However, they do take effort; and also patience.

The approach you’re about to read is the reason his company has returned 206% on long investments since 2012. For comparison S&P 500 has returned only 120%.

“Look for an investment thesis,” he begins, “the kind where you know the company so well, you can take advantage of volatility and not worry about short-term market fluctuations.”

He gives as an example his company’s investment in Anthem (ANTM), one of the five largest health insurance companies. “We were buying it heavily after the stock fell to $120 from $145. At that point it was exceedingly cheap.”

His research showed him that there were good reasons for this precipitous decline. Anthem faced uncertainty about whether its merger with Cigna would be approved, or denied due to antitrust regulations.

But that wasn’t the end of why Anthem’s stock was declining and investors were fleeing the company. There was also the discouraging fact that Anthem was losing money in the Obamacare exchanges.

And possibly most unnerving of all, with other insurers exiting the exchanges, Anthem might be acquiring a large amount of unprofitable business. Anthem might be locked into paying for health care for new patients that the company might not be able to afford.

It seemed to the general investor that Anthem was a stock to exit as fast as possible. However, not in Brode’s view. Anthem was exactly the kind of investment that Brode loves because he could see that a market misperception was causing what he thought was an error in pricing.

With so much going against Anthem, why would he want to buy it? “First,” he explains, “the stock was trading at a level that assumed the merger would not go through. This problem was already priced in. If the merger didn’t go through, we wouldn’t have lost anything.”

He goes on to say, “Next, when the press and the analysts were focusing on Anthem losing money on the exchanges, most failed to realize that Anthem was only committing to a year of coverage going forward. If they couldn’t make money in the exchanges, they’d be losing money for a year, but they could then exit the exchange. They weren’t locked in.”

As Brode points out, the market had priced Anthem as if the losses would be continuous going forward and not time-limited. In short, Silver Arrow calculated that the market had accounted for the downside fears but mispriced the upside opportunities.

“Acting on this investment thesis,” Brode says, “allowed us to make very large profits.”

Getting to the point where he and his partner, Raji Khabbaz, could take advantage of the opportunities embodied in Anthem required a deep knowledge of what was going on in the Department of Justice, the direction of health care legislation, and the nature of the insurance market.

“We don’t follow everyone else,” he summarizes. “We don’t do guesswork, and because we specialize in in-depth knowledge, our book is only 20 or 30 positions that we know very well.”

If you’d like more information on Silver Arrow Investment Management LL, contact Gary Brode at GB@silverarrowcap.com or call him at (917) 546-6821.

Search Articles

Latest Articles

Architect of Her Life

https://medium.com/@ken.roman_84029/architect-of-her-life-78e38401de71 Publication –medium.com

Meet Clara Kaluderovic

https://canvasrebel.com/meet-clara-kaluderovic Publication – canvasrebel.com

New Jersey drone sightings expose America’s battlefield blind spot

https://www.washingtontimes.com/news/2024/dec/23/new-jersey-drone-sightings-expose-america-battlefi Publication –washingtontimes.com

She Brews Hope and Resilience Even During War

https://foreignpress.org/journalism-resources/she-brews-hope-and-resilience-even-during-war Publication –foreignpress.org

Subscribe to Updates

About Author

Mitzi Perdue is the widow of the poultry magnate, Frank Perdue. She’s the author of How To Make Your Family Business Last and 52 Tips to Combat Human Trafficking. Contact her at www.MitziPerdue.com

All Articles

Family Businesses Can Learn from Military History

Family Businesses Can Learn from Military HistoryMilitary Culture My late husband was fascinated by military culture, and you could often find him reading the biographies of famous generals. His fascination stemmed from his interest in human motivation. He often...

Family Quarrels & Mediation–Pull Back from the Brink

Family Quarrels & Mediation– Pull Back from the BrinkI hope you’re not reading this because you’re up against a family quarrel. The pain of a family quarrel can permeate every hour of every day. The fallout has the potential of threatening everything we all hold...

What Family Businesses Can Learn From Military Culture

What Family Businesses Can Learn From Military CultureFor longevity and having an extraordinarily strong culture, few organizations can match our military. The military culture of our armed services began before the founding of our country, and it survives to this...

Four Sure-Fire Ways to Stand out in Your Career

Four Sure-Fire Ways to Stand Out in Your CareerA young man in a class I was addressing at a Columbia University business class asked me a poignant question. “How do I stand out in my career?” He was in his mid-twenties, professionally dressed, and his body language...

Family Stories Keep Families Together

Family Stories Keep Families TogetherJackie Kennedy Onassis once said: “If your children turn out well, nothing else matters. If your children turn out badly, nothing else matters.” Having the young people in your life turn out well is as important as anything else...

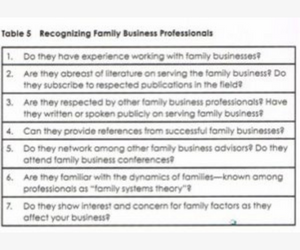

Choosing Your Family Business Advisors

Choosing Your Family Business AdvisorsKnow when you need to get help. People often ask me the secret of Frank Perdue’s success. He had to do hundreds of things right. He had to be able to see the big picture as well as be detail oriented. But there was something else:...