A Contrarian Investment that Could Be Just Right for You

Suppose for a moment that you’re an investor. Not just any investor. In this case you are Peter Hughes. You are a real person, although in fact Hughes is not your real name.

Here’s what’s going on with you, Mr. Hughes. You’re in your sixties, and you made millions in venture capital, funding startups. But now, like many people in your situation, you want to put this money in something tangible, something that you don’t have to spend a lot of time and effort managing. You are always looking for compelling opportunities in Real Estate for a portion of your long-term portfolio. However, as your scour the landscape, you find that many areas of Real Estate are expensive today; a result of a lot of money chasing the same opportunities since the recession.

So what’s left for you?

You’re about to find out because you’ve just sat down in a banquette at a local restaurant, with Chris Butler. This is his real name, and he’s here to propose something to you that’s both unique and contrarian.

You each order a vodka soda, you make some small talk and then you ask Chris to tell you about his idea.

“Our strategy is unique and contrarian,” he’d begin. “We like the entry level housing market because the fundamentals are very strong. Supply of these homes is about as low as it’s ever been, and there is a lot of pent up demand. This is an area of the economy that gives investors the potential to make an attractive return that might not be available with most other asset classes which are expensive now.

“Entry level housing,” you say, your sales resistance rising rapidly. “That doesn’t sound like the right space for me. Didn’t we learn from the 2008 crash to stay away from that?”

Butler would nod in agreement, “Yes, there is a lot negativity still lingering today, but things on the ground have changed, and that translates into an opportunity. The fundamentals are actually quite strong”

Butler would go on to point out that, “The supply of homes relative to demand is as low as it’s ever been in the United States by a number of measures. In 1994, there were the same number of homes for sale as there are today despite there being over 60 million more people.”

You lean forward and listen to what else he’s saying. “The demand for entry level homes is picking up as the issues that prevented homeownership over the last five years are starting to change. The younger cohort, those in the 20 to 34 age group, are seeing better job growth than in the past, and this growth is now higher than the national average. This is important because the economic health of this age cohort is crucial for new household formation

“But isn’t this the very group that’s doing most of the renting?” you object.

“Interestingly,” answers Butler, “renting is now more expensive than owning a home in most markets, which is one factor pushing households back towards homeownership. In fact, we have now seen two consecutive quarters where more new households bought than rented, which we believe is the start of a long-term trend. The biggest issue with the housing market today is supply can’t come on quick enough. And that’s where we come in. DF Capital Management will provide capital for private developers and homebuilders to construct new homes.”

“But what about the risk that comes with investing in construction and development of homes. Remember the lessons of 2006 and 2007!”

Butler has an answer. “Certainly no investment is without risk. However, in 2006 and 2007 the inventory level of new homes was abnormally high across most markets. However, it’s the exact opposite today. If you look back over history, when inventory is low the housing market has held up relatively well in a recession, and that is where we see things today.”

“Okay, I see your point,” you concede, “but real estate is so illiquid.”

“Being illiquid probably isn’t the obstacle that you might think it is,” he’d answer. “Investing in entry level housing would be for the long-term portion of your portfolio. Since this portion of your portfolio should be positioned for the highest returns, you are in a position to consider trading of liquidity in the short-term for higher potential returns in the long-term.

“OK, but what happens if there’s inflation?”

“As long as rates are going up because the economy is getting better, housing should be just fine. The average mortgage rate historically is around 7% while right now it’s hoovering down around 4%. We have a runway higher with rates before it becomes unaffordable.”

If the subject of entry level housing interests you, Chris Butler would like to talk with you.

E-mail him at chris.butler@dfcapitalmanagement.com or telephone him at

908 418 6601, DF Capital Management

Search Articles

Latest Articles

She Brews Hope and Resilience Even During War

https://foreignpress.org/journalism-resources/she-brews-hope-and-resilience-even-during-war Publication –foreignpress.org

Ukraine’s Mental Health Crisis & AI Solutions

https://aablanco.substack.com/p/ukraines-mental-health-crisis-and?utm_source=post-email-title&publication_id=1780826&post_id=153290811 Publication –aablanco.substack.com

Tackling Trauma Through Artificial Intelligence

https://www.psychologytoday.com/us/blog/to-end-human-trafficking/202411/tackling-trauma-through-artificial-intelligence Publication –psychologytoday.com

The Diplomat Mitzi Perdue Nantucket Ukraine

https://www.n-magazine.com/the-diplomat-mitzi-perdue-nantucket-ukraine Publication –n-magazine.com

Subscribe to Updates

About Author

Mitzi Perdue is the widow of the poultry magnate, Frank Perdue. She’s the author of How To Make Your Family Business Last and 52 Tips to Combat Human Trafficking. Contact her at www.MitziPerdue.com

All Articles

Family Businesses Can Learn from Military History

Family Businesses Can Learn from Military HistoryMilitary Culture My late husband was fascinated by military culture, and you could often find him reading the biographies of famous generals. His fascination stemmed from his interest in human motivation. He often...

Family Quarrels & Mediation–Pull Back from the Brink

Family Quarrels & Mediation– Pull Back from the BrinkI hope you’re not reading this because you’re up against a family quarrel. The pain of a family quarrel can permeate every hour of every day. The fallout has the potential of threatening everything we all hold...

What Family Businesses Can Learn From Military Culture

What Family Businesses Can Learn From Military CultureFor longevity and having an extraordinarily strong culture, few organizations can match our military. The military culture of our armed services began before the founding of our country, and it survives to this...

Four Sure-Fire Ways to Stand out in Your Career

Four Sure-Fire Ways to Stand Out in Your CareerA young man in a class I was addressing at a Columbia University business class asked me a poignant question. “How do I stand out in my career?” He was in his mid-twenties, professionally dressed, and his body language...

Family Stories Keep Families Together

Family Stories Keep Families TogetherJackie Kennedy Onassis once said: “If your children turn out well, nothing else matters. If your children turn out badly, nothing else matters.” Having the young people in your life turn out well is as important as anything else...

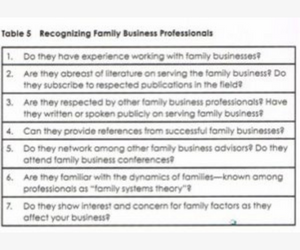

Choosing Your Family Business Advisors

Choosing Your Family Business AdvisorsKnow when you need to get help. People often ask me the secret of Frank Perdue’s success. He had to do hundreds of things right. He had to be able to see the big picture as well as be detail oriented. But there was something else:...